Strange Days June 8'th, 2011 - NatGas Algo

|

Back to

Table Of Contents

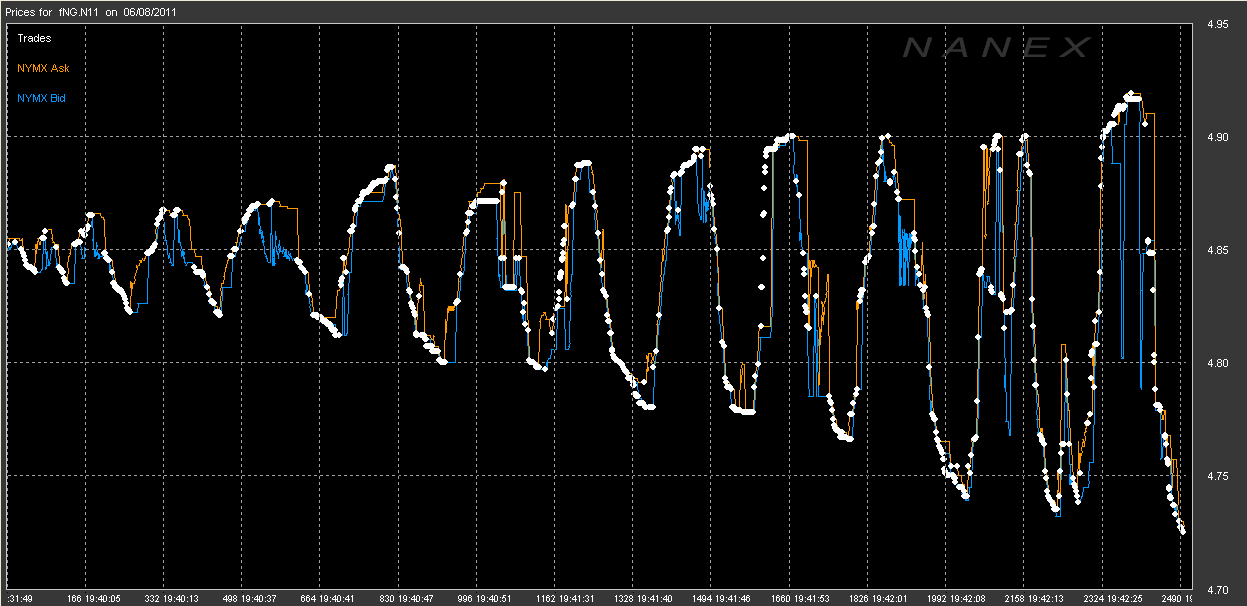

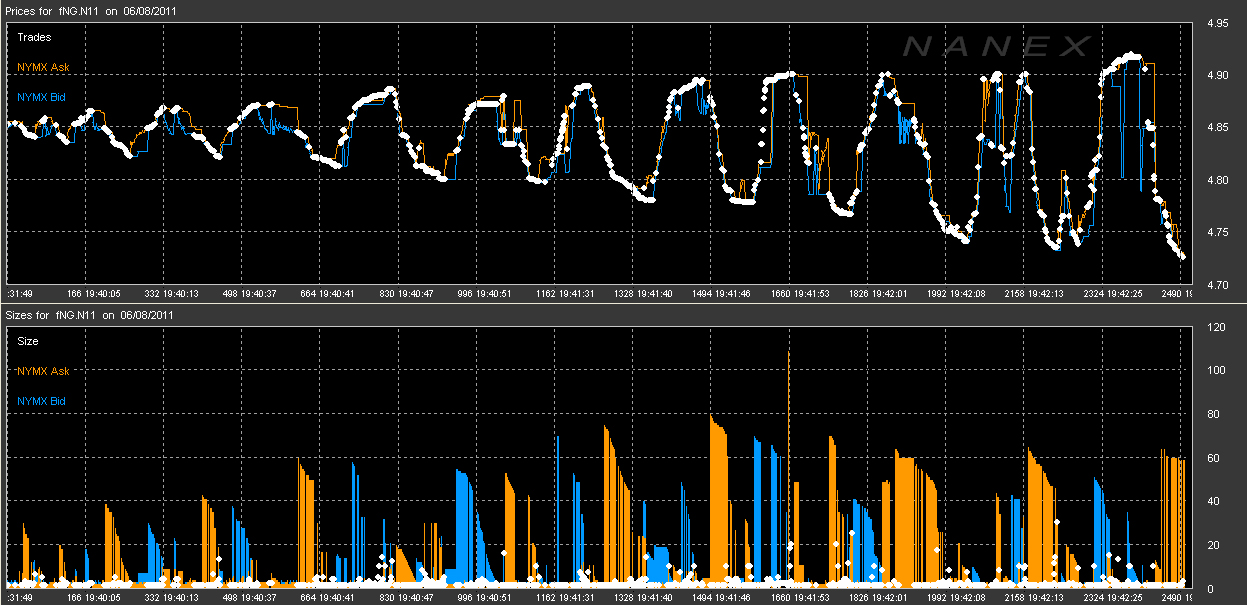

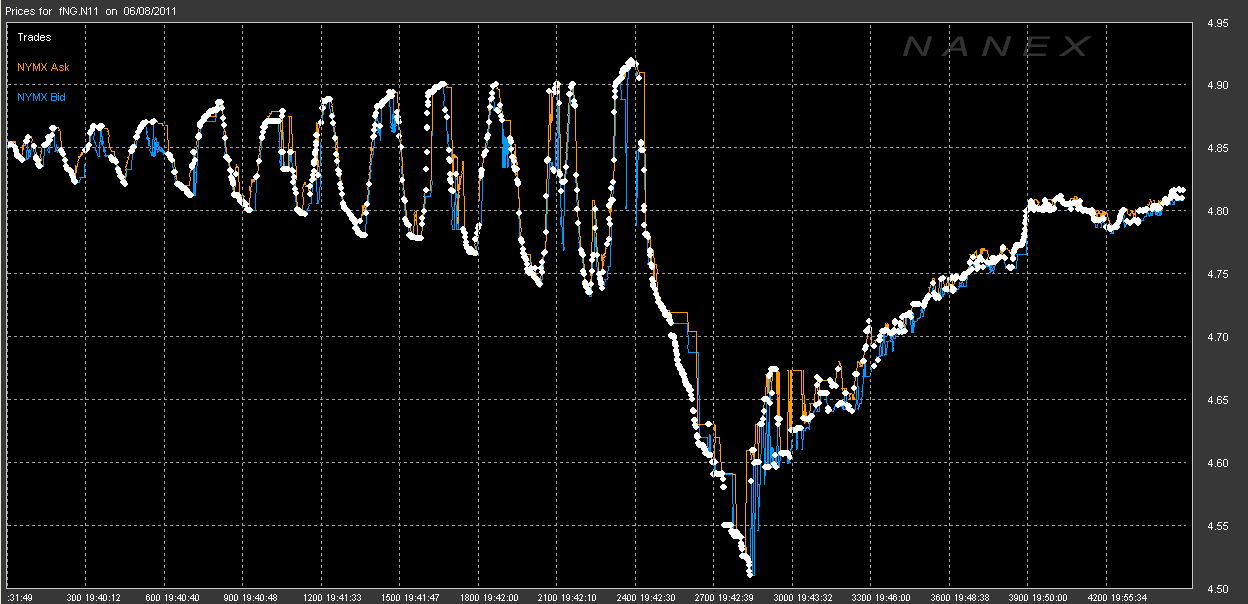

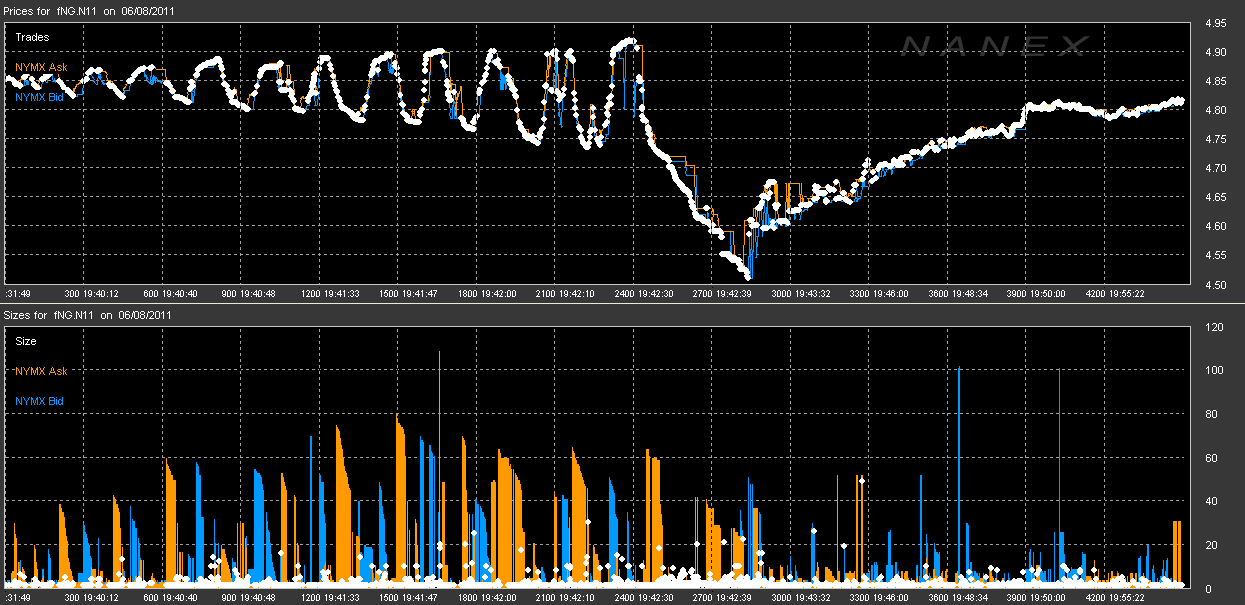

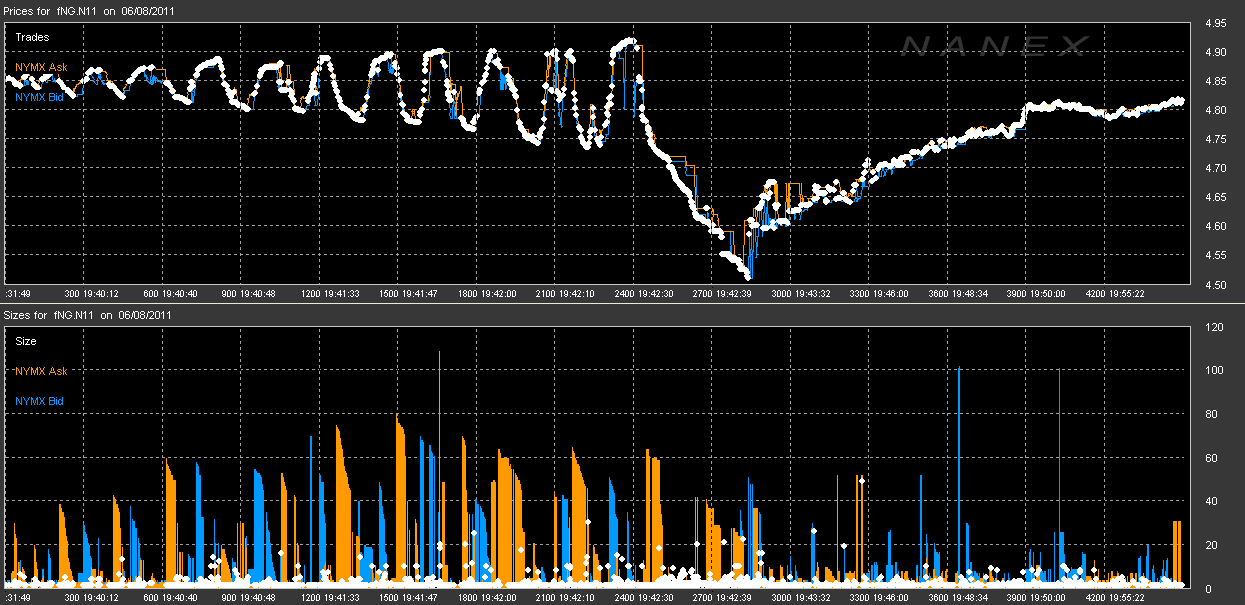

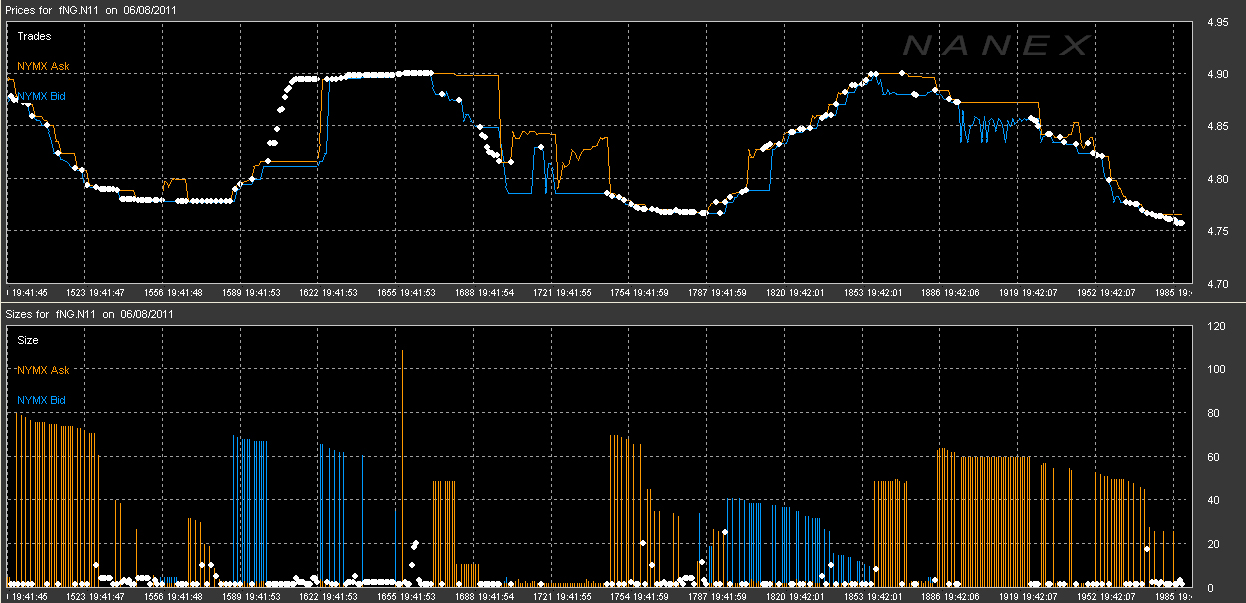

In the following chart, trades and quotes are plotted sequentially as they

occur. As such, no data is lost. Exchange's bid and ask prices are colored

according to the legend on the left. Trades are colored in white.

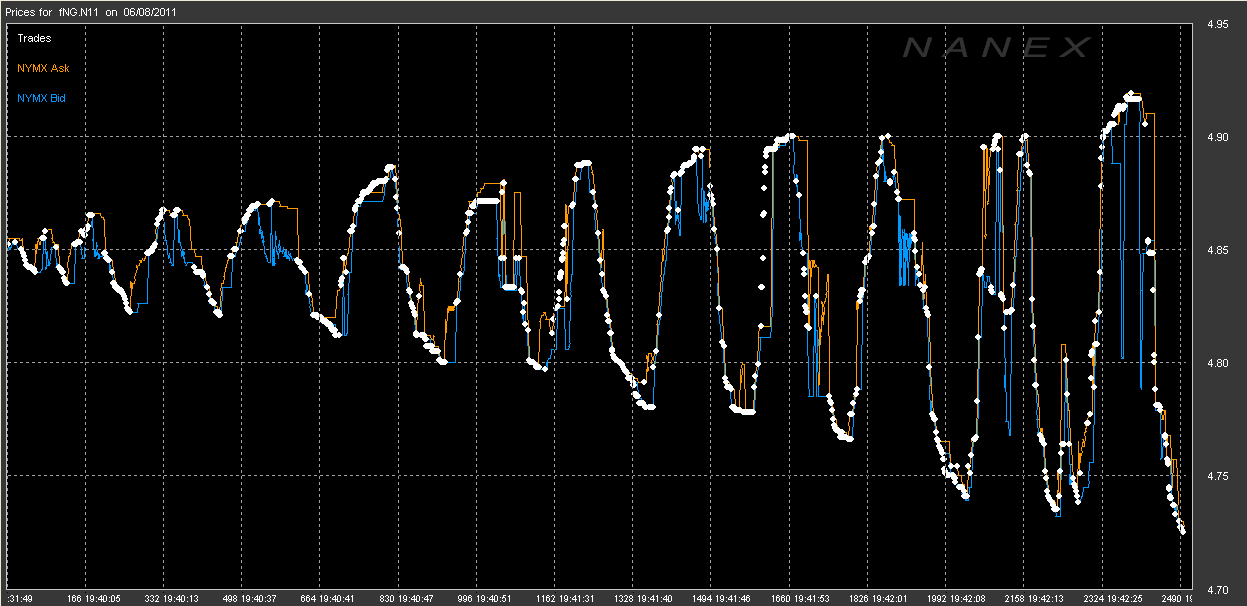

Activity before the drop, prices only:

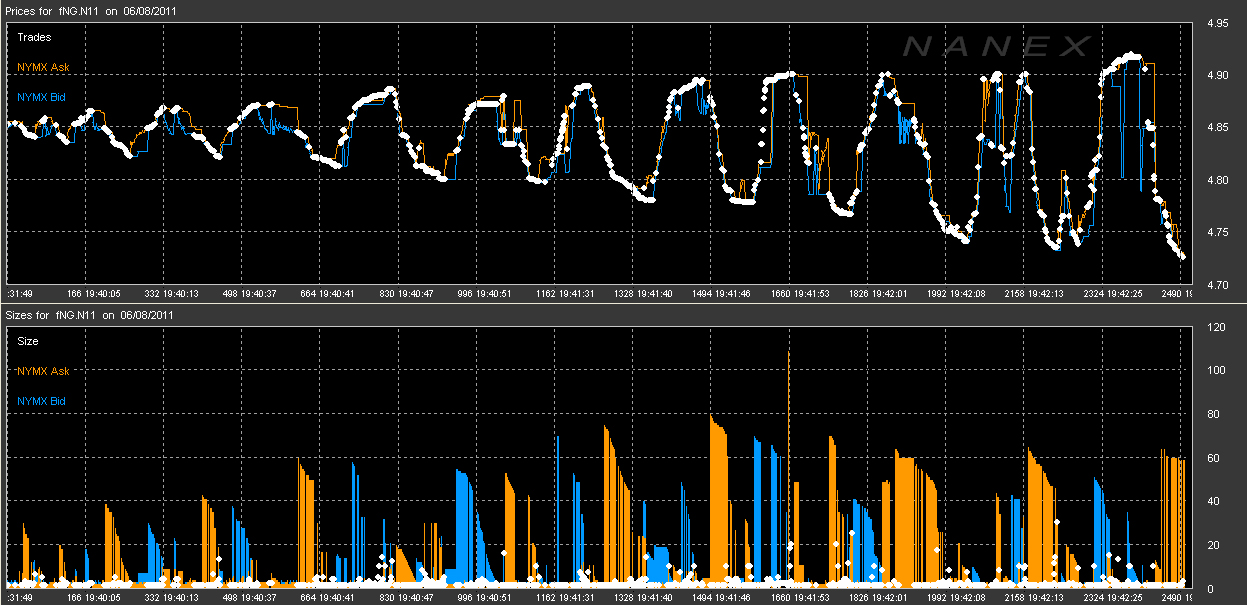

Activity before the drop, prices and size:

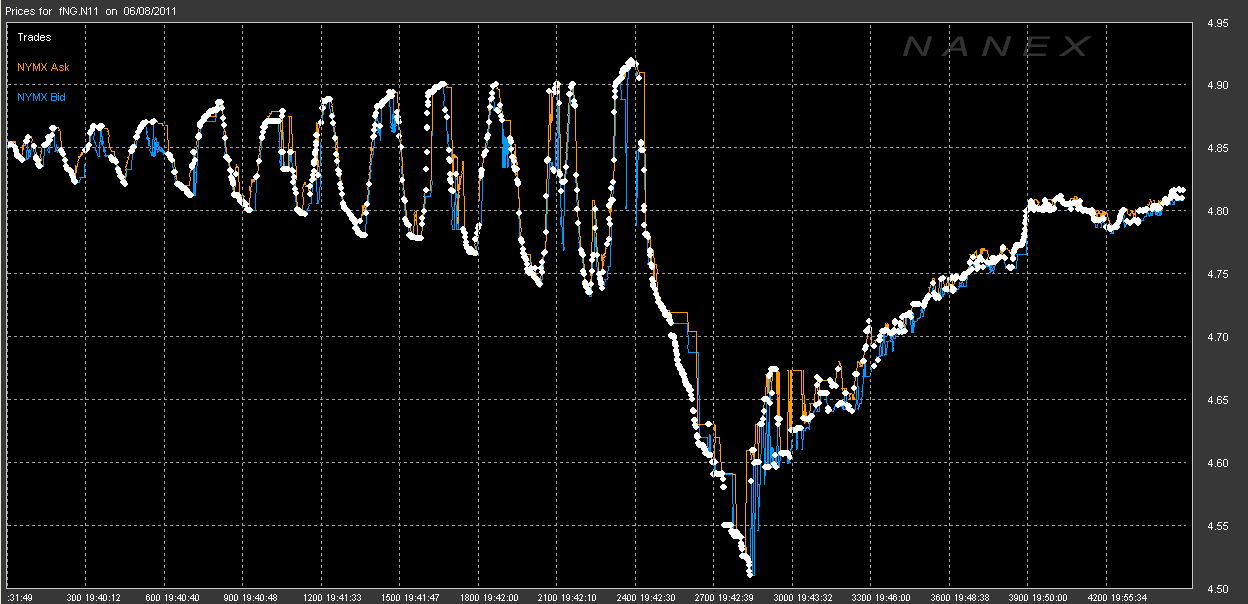

Activity after the drop, prices only:

Activity after the drop, prices and size:

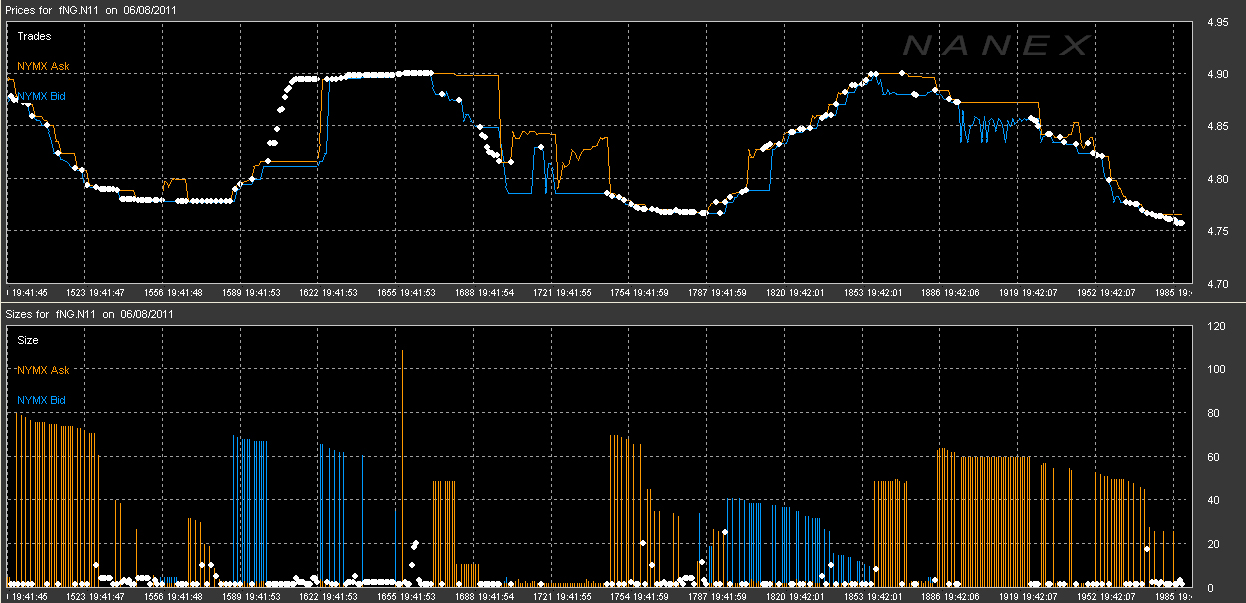

Zoom in of the pattern:

The following charts show trade, trade volume, and depth of book prices and

relative sizes for the July 2011 Natural Gas futures trading on NYMEX. Depth of

book data is color coded by color of the rainbow (ROYGBIV), with red

representing high bid/ask size and violet representing low bid/ask size. In

this way, we can easily see changes in size to the depth of the trading book

for this contract.

Depth of book is 10 levels of bid prices and 10 levels of ask prices. The bid

levels start with the best (highest) bid, and drop in price 10 levels. Ask

levels start with the best (lowest) ask, and increase in price 10 levels. The

different in price between levels is not always the same. It depends on traders

submitting bids and offers. In other words, depth of book shows the 10 best bid

prices, and 10 best ask prices.

In a normal market, prices move lower when the number of contracts at the top

level bid are executed. The next highest bid level then becomes the top level,

and the 3rd level becomes the second and so forth. A new level is then added

below the previous lowest level. On our our depth charts display, you would see

this behavior as a change in color of the top level bid from the red end of the

spectrum towards the violet end.

On June 8, 2011, starting at 19:39 Eastern Time, trade prices began oscillating

almost harmonically along with the depth of book. However, prices rose as bid

were executed, and prices declined when offers were executed -- the exact

opposite of a market based on supply and demand. Notice that when the prices go

up, the color on the ask side remains mostly unchanged, but the color on the

bid side goes from red to violet. When prices go down, the color on the bid

side remains mostly unchanged, but the color on the ask side goes from red to

violet. This is highly unusual.

Upon closer inspection, we find that price oscillates from low to high when

trades are executing against the highest bid price level. After reaching a

peak, prices then move down as trades execute against the highest ask price

level. This is completely opposite of normal market behavior.

The amplitude (difference between the highest price and lowest price) of each

oscillation slowly increases, until a final violent downward swing on high

volume. There also appears to be 3 groups of these oscillations or perhaps two

intervals separating these oscillations. It's almost as if someone is executing

a new algorithm that has it's buying/selling signals crossed. Most disturbing

to us is the high volume violent sell off that affects not only the natural gas

market, but all the other trading instruments related to it. |

|

Inquiries: pr@nanex.net

Publication Date: 06/08/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|